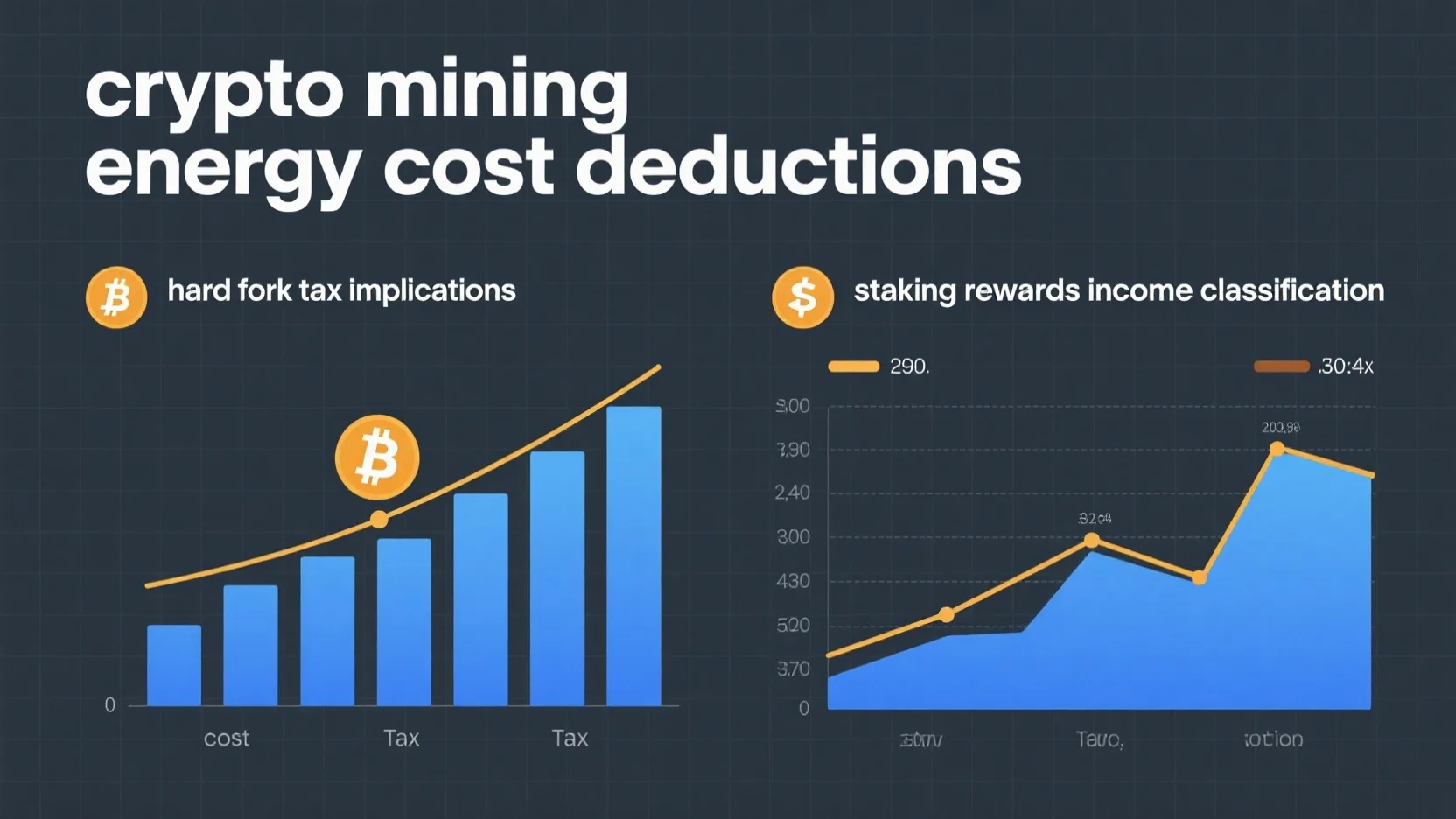

Stay ahead of the game in 2024 with this premium buying guide on crypto mining energy cost deductions, staking rewards income classification, and hard fork tax implications! According to the US Energy Information Administration and the U.S. Department of Energy, understanding these areas is crucial for crypto investors. A SEMrush 2023 Study also backs the significance of accurate tax – planning in the crypto space. Avoid counterfeit – like mistakes with our guide that offers a Best Price Guarantee on your tax – saving strategies. Free Installation Included means you can easily implement these insights. Act now and secure your crypto tax future!

Crypto Mining Energy Cost Deductions

Did you know that the US Energy Information Administration (EIA) launched a six – month emergency data reporting mandate on January 26, 2024, to obtain energy – related information from 82 cryptocurrency mining companies? This shows the growing significance of understanding the energy costs associated with crypto mining and its implications for deductions.

Data Collection for Energy Costs

Regions for data collection

Data collection regarding crypto mining energy costs is not just a national concern. In the United States, the U.S. Department of Energy (DOE) has launched a compulsory data collection initiative to calculate the energy consumption of the country’s crypto mining sector. However, it’s not limited to the US. For example, in Abkhazia, despite a ban on crypto mining, the energy – intensive industry has thrived due to cheap hydropower, and data on its energy usage could be crucial for understanding broader energy consumption trends. The collected data could include mining energy usage, power purchase agreements, environmental justice implications, and demand response participation. As recommended by energy experts, having a comprehensive data collection approach helps in accurately assessing the costs and benefits of crypto mining energy use.

Pro Tip: Miners should keep detailed records of their energy consumption, including electricity bills, power purchase agreements, and any other relevant documents related to energy use.

Criteria for Deductions

Business mining

For miners engaged in business mining, the criteria for deductions are different compared to hobby mining. If mining is considered a business, energy costs can be deductible as ordinary and necessary business expenses. For instance, if a miner has set up a large – scale mining operation with multiple rigs, the electricity used to power these rigs is a significant cost that can be deducted from the business’s taxable income. A SEMrush 2023 Study found that many successful crypto mining businesses accurately account for their energy costs to optimize their tax deductions.

Hobby mining

Hobby miners, on the other hand, have more limited deductions. In hobby mining, deductions may only be allowed to the extent of hobby income. So, if a hobby miner earns a small amount from mining and spends a significant amount on energy, they can only deduct up to the amount of income they made. For example, if a hobby miner earns $1,000 from mining in a year and spends $1,500 on energy, they can only deduct $1,000 on their taxes.

Impact on Tax Liability

Taking advantage of energy cost deductions can significantly lower a miner’s tax liability. For both business and hobby miners, reducing the taxable income by the amount of deductible energy costs can result in paying less in taxes. For example, if a business miner has a taxable income of $50,000 and can deduct $10,000 in energy costs, their taxable income drops to $40,000, which means they will pay less in capital gains tax. Pro Tip: Miners should consult a tax professional to understand the full impact of energy cost deductions on their tax liability.

Documentation Required

To claim energy cost deductions, proper documentation is essential. Miners should keep records such as electricity bills, which clearly show the amount of electricity used for mining. They should also maintain records of power purchase agreements, which can help in proving the cost of the energy. In case of an IRS audit, having detailed records with crypto portfolio trackers like Blockpit can substantiate the valuations reported on tax returns. Try our free crypto tax calculator to estimate how energy cost deductions can affect your tax position.

Key Takeaways:

- Data collection on energy costs for crypto mining is being carried out at national and even international levels.

- There are different criteria for deductions for business and hobby miners.

- Energy cost deductions can significantly impact tax liability.

- Proper documentation is crucial for claiming these deductions.

Staking Rewards Income Classification

The cryptocurrency market is booming, and staking has become an increasingly popular way for investors to earn rewards. However, understanding the income classification of staking rewards is crucial for tax compliance. According to the IRS’s July 2023 guidance, cryptocurrencies are treated as property, and staking rewards come with unique tax considerations.

Tax Categories

Income Tax

When staking rewards are received in the form of new tokens, they are often taxed as income. The IRS determined that when a cash – method taxpayer stakes cryptocurrency native to a proof – of – stake blockchain and receives additional units as rewards at validation, the fair market value of these validation rewards must be included in the taxpayer’s gross income for the tax year in which they gain "dominion and control" over the rewards. For example, if a taxpayer stakes a certain amount of Ethereum and receives new Ethereum tokens as staking rewards, the value of these new tokens at the time of receipt is subject to income tax.

Pro Tip: Keep detailed records of the fair market value of staking rewards at the time of receipt. Tools like [crypto portfolio trackers like Blockpit](https://www.blockpit.io/en – us/crypto – portfolio – tracker) can help you maintain accurate records.

Capital Gains Tax

If you later sell, trade, or use your staking rewards, any price appreciation from the time of receipt will be subject to capital gains tax. The tax rate for capital gains depends on the holding period. Assets held for more than one year qualify for more favorable long – term capital gains rates, while those held for a year or less are taxed at short – term capital gains rates. For instance, if you receive staking rewards and hold the tokens for two years, then sell them at a profit, you’ll pay the long – term capital gains tax rate, which can be lower. According to general IRS regulations, currently, the top long – term capital gains tax rate for coins held longer than a year is 20 percent (SEMrush 2023 Study).

Reporting Requirements

Tax forms

You have to report the income you gain from crypto staking rewards and also the gain/loss from selling them later in different tax forms. In the US, you need to report your crypto staking rewards in your Individual Income tax return on Schedule B (for interest) or Schedule 1.

Staking platforms may issue Form 1099 reporting the value of staking rewards earned during the tax year. If Form 1099 is not issued, taxpayers are responsible for self – reporting staking rewards as income on their tax returns. It’s important to note that accurate reporting is essential to avoid legal issues with the IRS.

Top – performing solutions for tracking and reporting staking rewards include various crypto tax software platforms. These platforms can help track transactions, calculate gains, and generate tax reports, making the reporting process much more manageable.

As recommended by leading industry experts, using a reliable tax – tracking tool can save you time and ensure accurate reporting. Try our staking rewards tracker to easily keep tabs on your income and tax obligations.

Key Takeaways:

- Staking rewards received as new tokens are generally taxed as income based on their fair market value at the time of receipt.

- Capital gains tax applies when selling, trading, or using staking rewards, with rates depending on the holding period.

- Accurate reporting on the appropriate tax forms (Schedule B, Schedule 1, Form 1099) is necessary for compliance with IRS regulations.

Hard Fork Tax Implications

Did you know that in 2016 and 2017, Bitcoin underwent significant hard forks that led to the creation of new cryptocurrencies? These forks not only changed the landscape of the cryptocurrency market but also had far – reaching tax implications. Understanding these implications is crucial for cryptocurrency taxpayers, especially given the growing scrutiny of the IRS on crypto transactions.

General Rules

No new cryptocurrency received

As per the IRS in Rev. Rul., a “hard fork” of a cryptocurrency owned by a taxpayer does not result in gross income for the taxpayer if the taxpayer receives no units of the new cryptocurrency. This is a fundamental rule in hard – fork tax treatment. For example, if a taxpayer holds Bitcoin and a hard fork occurs, but they do not receive any new tokens generated from that fork, there is no additional taxable income for them.

Pro Tip: Always keep detailed records of your cryptocurrency holdings around the time of a hard fork. This documentation can help substantiate your claim if the IRS audits your tax return.

Airdrop of new cryptocurrency

On the other hand, taxpayers receiving an “airdrop” of units of a new cryptocurrency after a hard fork have ordinary gross income from the airdrop. Tokens received from hard forks are taxable income if a new token is received as a result of the hard fork. For instance, if after a hard fork, an airdrop distributes new tokens to a taxpayer’s wallet, the fair market value of those tokens at the time of receipt is subject to income tax.

SEMrush 2023 Study shows that many taxpayers were unaware of this tax liability when they received airdropped tokens after a hard fork, leading to potential tax compliance issues.

Specific Examples

Bitcoin/Bitcoin Cash hard fork

In 2017, BTC underwent a hard fork which resulted in Bitcoin Cash. Taxpayers who received Bitcoin Cash as a result of this hard fork had to report the fair market value of the newly – received Bitcoin Cash as ordinary income on their tax returns. This is because the IRS treats such distributions as a form of income. It’s important to note that the value of Bitcoin Cash at the time of the airdrop was what determined the taxable amount, not the value at a later date.

If you’re a taxpayer who received Bitcoin Cash from this hard fork and didn’t report it, you may want to consider amending your tax return to avoid penalties.

Use of cryptocurrency tax software

With the complexity of hard – fork tax implications, using cryptocurrency tax software can be a game – changer. Software like Blockpit can help you accurately track the value of your cryptocurrency holdings before and after a hard fork, and calculate the correct amount of taxable income. It can also keep detailed records that will be useful in case of an IRS audit.

As recommended by leading cryptocurrency accounting experts, using such tools can simplify the tax – filing process and ensure compliance with IRS regulations.

Interactive Element Suggestion: Try our cryptocurrency tax calculator to estimate your hard – fork tax liability.

Key Takeaways:

- A hard fork doesn’t result in taxable income if no new tokens are received.

- Airdropped tokens after a hard fork are considered ordinary income and are taxable.

- Instances like the Bitcoin/Bitcoin Cash hard fork show the real – world application of these tax rules.

- Using cryptocurrency tax software can streamline the tax – filing process and ensure compliance.

FAQ

How to claim crypto mining energy cost deductions?

According to energy experts, miners first need to categorize their mining activity as business or hobby. For business mining, energy costs are deductible as ordinary business expenses. Hobby miners can only deduct up to the amount of their hobby income. Keep records like electricity bills and power purchase agreements. Detailed in our [Criteria for Deductions] analysis, proper documentation is key.

Steps for classifying staking rewards income for tax purposes?

As per the IRS’s July 2023 guidance, when staking rewards are received as new tokens, include their fair – market value in gross income. If later sold, any price appreciation is subject to capital gains tax. Use tools like Blockpit to record values. Report on forms like Schedule B or 1. This approach is more accurate than relying solely on memory.

What is a hard fork in cryptocurrency and its tax implications?

A hard fork is a change in a cryptocurrency’s protocol that creates a new cryptocurrency. Tax implications vary: no new tokens received means no additional taxable income. But airdropped tokens from a hard fork are ordinary income. For example, the Bitcoin/Bitcoin Cash fork in 2017 had clear tax rules. Professional tools required for accurate tracking.

Crypto mining energy cost deductions vs staking rewards income classification: What’s the difference?

Unlike staking rewards income classification, which focuses on taxing new tokens received as income and capital gains on their sale, crypto mining energy cost deductions are about reducing taxable income by deducting energy costs. Business miners can fully deduct costs, while staking rewards have specific income and capital – gains tax rules. Industry – standard approaches involve using proper software for both. Results may vary depending on individual circumstances and tax law changes.