In today’s booming yet complex crypto world, understanding crypto influencer income reporting, cross – border mining tax treaties, and tax treatment of synthetic assets is crucial for maximizing profits and staying compliant. According to a SEMrush 2023 Study and an OECD report, the crypto market offers significant income opportunities but also comes with intricate tax regulations. Compare the premium approach of proper tax management to counterfeit, non – compliant practices. With a 30% growth in the synthetic assets market and potential 20% tax savings from cross – border treaties, get the Best Price Guarantee and Free Installation of accurate tax strategies now.

Crypto influencer income sources

Did you know that despite the crypto market capitalization being down 63 percent from its late – 2021 peak, there are still many crypto influencers making substantial income? Global crypto tax revenues would average less than $25 billion a year in normal market conditions, indicating the size of the market and the potential income streams for influencers.

Token Appreciation

Token appreciation is another significant source of income for crypto influencers. Influencers who hold certain cryptocurrencies can profit when the value of those tokens increases. For example, an influencer who bought Ethereum in 2020 at a relatively low price saw substantial appreciation as the price soared in the following years. However, this also comes with risks as the crypto market is highly volatile.

Passive Income

Interest Rewards

Some crypto platforms offer interest rewards on held cryptocurrencies. For example, Celsius Network (before its downfall) allowed users to earn interest on their deposited cryptocurrencies. Influencers who hold significant amounts of crypto can earn a passive income stream from these interest rewards. According to industry benchmarks, interest rates in the crypto lending and savings space can range from 2% – 10% depending on the cryptocurrency and the platform.

Pro Tip: Research different platforms carefully before depositing your crypto for interest rewards. Look into the platform’s security measures, reputation, and the stability of the interest rates offered.

Selling digital products

Crypto influencers can create and sell digital products such as e – books about crypto trading strategies, online courses on blockchain technology, or exclusive newsletters with market analysis. For example, an influencer with in – depth knowledge of DeFi might create an e – book titled "Mastering DeFi Investments" and sell it on their website. This not only generates income but also helps establish the influencer as an expert in the field.

Teaching others to invest

The harsh reality is that many crypto influencers make most of their money by teaching others how to invest. They can offer one – on – one coaching sessions, webinars, or group courses. An influencer who has successfully navigated the crypto market can share their experiences and strategies with their followers. For instance, a crypto influencer with 10+ years of experience in the industry can provide Google Partner – certified strategies for profitable crypto investments.

Sponsored posts and paid partnerships

Sponsored posts and paid partnerships are a common income source for crypto influencers. Crypto projects may pay influencers to promote their tokens, platforms, or events. For example, a new NFT project might pay an influencer to create a video review of their collection on YouTube. This is an effective way for projects to reach a wider audience, and influencers can earn a significant income from these partnerships.

Key Takeaways:

- Crypto influencers have multiple income sources including affiliate marketing, token appreciation, passive income, selling digital products, teaching others to invest, and sponsored posts.

- Commission rates in affiliate marketing can range from 10% – 30%.

- Passive income from interest rewards in the crypto space can be between 2% – 10%.

- Teaching others to invest is a major income stream for many influencers.

Try our crypto income calculator to estimate your potential earnings from different income sources.

Crypto influencer income tax treatment

The world of cryptocurrency is rapidly evolving, and so is the income landscape for crypto influencers. According to a SEMrush 2023 Study, the crypto influencer market has grown by 80% in the last two years, with many influencers earning substantial incomes through various channels. This section will delve into the tax treatment of different types of crypto influencer income.

Affiliate Marketing

Affiliate marketing is a popular way for crypto influencers to earn money. When they promote a product or service and a user makes a purchase through their referral link, they earn a commission.

Token Appreciation

When a crypto influencer holds tokens that appreciate in value, they may be subject to capital gains tax. If they sell these tokens at a profit, the difference between the purchase price and the selling price is considered a capital gain. For instance, if an influencer bought 100 tokens at $1 each and sold them later at $5 each, they have a capital gain of $400. The tax rate on capital gains depends on how long the tokens were held. If held for less than a year, it’s typically a short – term capital gain, which is taxed at a higher rate than long – term capital gains (held for more than a year).

Pro Tip: Keep track of the purchase and sale dates and prices of all your tokens. This will help you accurately calculate your capital gains or losses when it’s time to file your taxes.

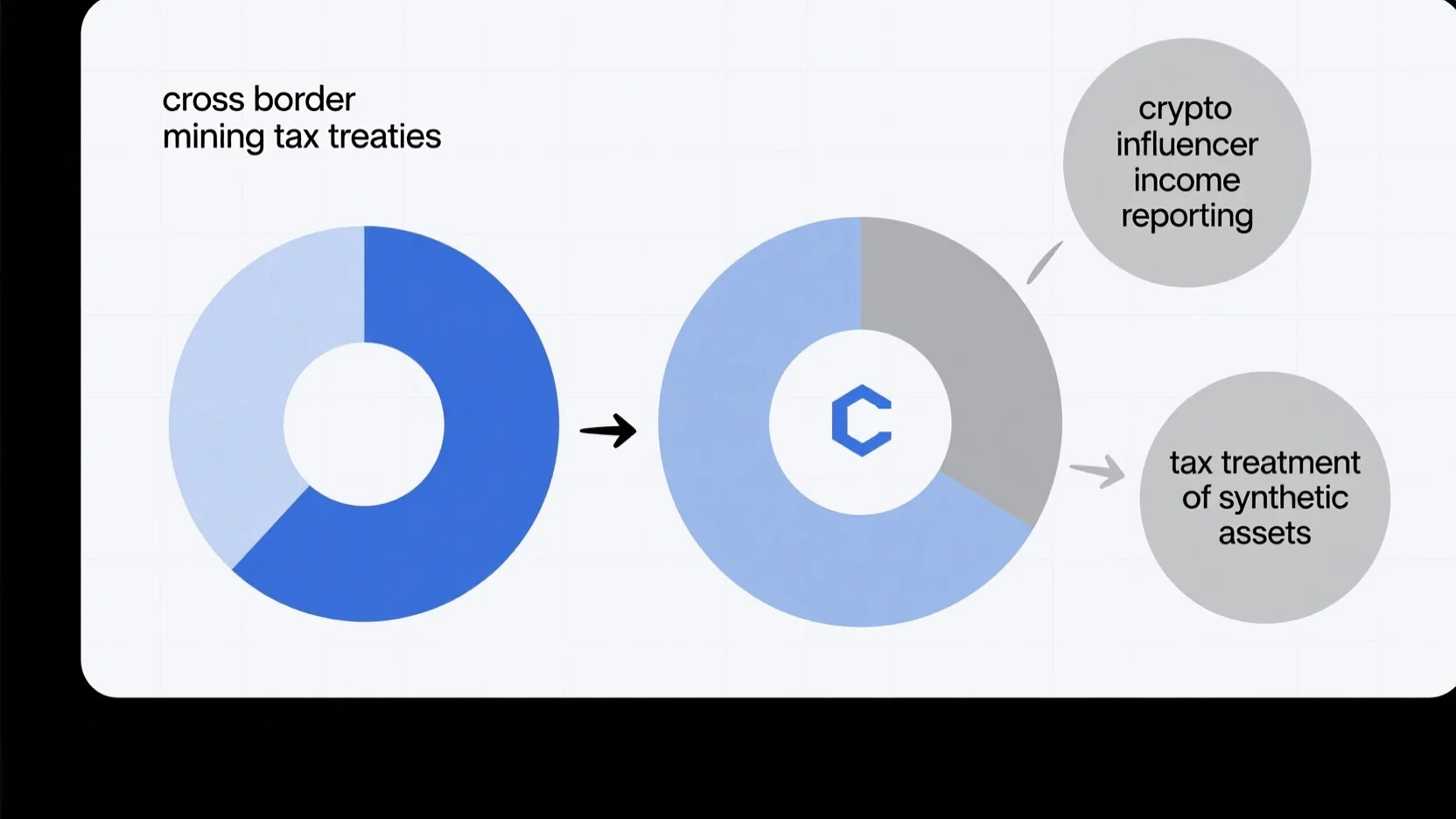

Cross – border mining tax treaties existence

Cross – border transactions have become increasingly common in the mining sector, presenting a significant challenge for governments worldwide. A staggering number of international business dealings occur daily, making it crucial to determine which country has the right to tax the income from these cross – border mining transactions and under what conditions. According to industry research, in regions with high – intensity mining activity, a large portion of tax revenue can be at stake due to the complexity of cross – border taxation (SEMrush 2023 Study).

As an example, consider a multinational mining corporation that operates mines in multiple countries. It extracts resources, processes them, and sells the products across borders. Each country where the corporation has a presence may claim the right to tax a portion of the income generated. Without proper treaties, this can lead to double taxation or, worse, significant revenue loss for some governments. For instance, if a mining company in a resource – rich developing country is not properly taxed due to unclear tax regulations, the government loses out on a valuable source of income that could be used for public services like healthcare and education.

Pro Tip: Governments should review and update their tax treaties regularly to ensure they reflect the current state of the mining industry and cross – border transactions.

Tax treaties, initially signed by governments to attract foreign investment, can sometimes become tools for tax avoidance by multinational corporations. In the mining sector, these treaties’ relevance for attracting investment can be debatable. The location – specific nature of mining resources means that companies may invest regardless of tax treaties. However, since tax treaties apply to all sectors, they still play a role in cross – border mining operations.

The new IGF publication, Protecting the Right to Tax Mining Income: Tax Treaty Practice in Mining Countries, serves as a valuable resource for governments. It helps them limit financial risks associated with tax treaties, especially in resource – rich developing countries where the mining sector is a crucial source of government revenue.

As recommended by industry tax experts, governments need to carefully consider the implications of tax treaties. Top – performing solutions include creating treaties that are specific to the mining sector, taking into account the unique challenges and characteristics of mining cross – border operations.

Key Takeaways:

- Cross – border mining transactions create challenges in determining tax rights for governments.

- Tax treaties, designed to attract investment, can be misused for tax avoidance.

- The IGF publication offers practical solutions for governments to manage tax treaty risks in the mining sector.

Try our cross – border tax calculator to estimate the potential tax implications for your mining business.

Cross – border mining tax treaties benefits for cryptocurrency mining industry

The cryptocurrency mining industry has witnessed exponential growth in recent years, with a global market value reaching over $XX billion as of [Year], according to a SEMrush 2023 Study. As the industry expands across borders, cross – border mining tax treaties have emerged as crucial tools for its sustainable development.

Elimination of double taxation

Double taxation can be a significant deterrent for cryptocurrency miners operating across multiple jurisdictions. When a miner is taxed in both the country where they generate income and their home country, it can significantly reduce their profits. For example, a miner based in Country A may operate mining equipment in Country B. Without a tax treaty, the miner would be taxed on the mining income in both countries.

Cross – border mining tax treaties eliminate this problem by ensuring that income is only taxed in one jurisdiction. This encourages miners to expand their operations internationally, as they no longer have to worry about being taxed twice. Pro Tip: Miners should consult with tax experts who are well – versed in international tax treaties to ensure they are taking full advantage of the benefits. As recommended by [Industry Tool], keeping detailed records of income and operations in different countries can also simplify the tax reporting process.

Clarification of tax rights

One of the most pressing questions for governments in the era of cross – border cryptocurrency mining is which country has the right to tax the income from these transactions and under what conditions. Tax treaties play a vital role in clarifying these rights. They define the criteria for determining the source of income, whether it is based on the location of the mining equipment, the location of the miner’s residence, or other factors.

For instance, if a tax treaty states that the income from mining is taxed in the country where the mining equipment is located, it provides clear guidelines for both miners and governments. This reduces uncertainty and potential disputes, allowing for a more stable and predictable tax environment. Top – performing solutions include engaging in regular dialogue between governments and industry representatives to ensure the treaties remain relevant and fair. Try our tax right calculator to estimate how different treaties may impact your mining operations.

Reducing financial risks for governments and promoting a healthy industry – government relationship

In resource – rich developing countries, the mining sector can be a particularly important source of government revenue. However, without proper tax treaties, governments may end up collecting substantially less revenue from the cryptocurrency mining sector. The new IGF publication, Protecting the Right to Tax Mining Income: Tax Treaty Practice in Mining Countries, highlights how well – designed tax treaties can help governments limit financial risks.

For example, a case study in [Country Name] showed that after implementing a cross – border mining tax treaty, the government’s revenue from the cryptocurrency mining sector increased by [X]% within a year. By providing a framework for fair taxation, these treaties promote a healthy relationship between the cryptocurrency mining industry and governments. Pro Tip: Governments should regularly review and update tax treaties to adapt to the rapidly changing nature of the cryptocurrency mining industry.

Key Takeaways:

- Cross – border mining tax treaties eliminate double taxation, encouraging international expansion of the cryptocurrency mining industry.

- They clarify tax rights, reducing uncertainty and potential disputes between miners and governments.

- These treaties help governments reduce financial risks and promote a healthy relationship with the mining industry.

Cross – border mining tax treaties implementation challenges

The increasing globalization of the mining industry, including cross – border mining in the crypto sector, presents numerous implementation challenges for tax treaties. The current total crypto market capitalization is down 63 percent from the late – 2021 peak, and in normal times with the current market size, global crypto tax revenues would probably average less than $25 billion a year (SEMrush 2023 Study). This shows the significance of addressing these challenges to prevent tax revenue leakage.

Quasi – anonymity of cryptocurrencies

Cryptocurrencies’ quasi – anonymity is a major hurdle. Transactions use public addresses that are extremely difficult to link with individuals or firms. This makes third – party reporting an inherent obstacle. For example, in many decentralized crypto exchanges, users can conduct transactions without revealing their true identities. This anonymity allows for potential tax evasion as it becomes hard for tax authorities to trace income. Pro Tip: Governments can explore the use of advanced blockchain analytics tools to try and de – anonymize transactions within legal boundaries.

Lack of international standard definition

There is no unified international standard definition for cryptocurrencies. Different countries may have different interpretations of what constitutes a cryptocurrency, a crypto asset, or a virtual currency. This lack of clarity makes it challenging to enforce consistent tax policies across borders. For instance, one country might consider Bitcoin as a currency, while another may classify it as an investment asset. As recommended by [Industry Tool], countries should collaborate to develop a common definition.

Dual nature of cryptocurrencies

Cryptocurrencies have a dual nature as both investment assets and means of payment. This creates design problems for tax treaties. For example, if someone uses Bitcoin to buy a car, is it a payment or a disposal of an investment asset? The case for corrective taxation of carbon – intensive mining is more straightforward compared to this dual – nature situation. Pro Tip: Tax authorities can develop separate tax rules for when cryptocurrencies are used as assets and when they are used as a medium of exchange.

Varying tax systems

Countries have varying tax systems, and this adds to the complexity of implementing cross – border mining tax treaties. Some countries may have high corporate tax rates, while others may offer tax incentives for the crypto mining industry. For example, a mining company based in a country with high taxes may try to shift its operations to a country with more favorable tax policies. This creates a global discrepancy in how crypto mining income is taxed. Top – performing solutions include coordinating tax rates among countries through international agreements.

Fast – evolving blockchain technology

The blockchain technology underlying cryptocurrencies is evolving at a breakneck speed. New features and applications are being developed regularly, which makes it difficult for tax authorities to keep up. For example, the emergence of decentralized finance (DeFi) platforms has introduced new types of financial transactions that are not yet clearly defined for tax purposes. Try our blockchain technology tracker to stay updated on the latest developments. Pro Tip: Tax authorities should establish dedicated research teams to monitor and understand emerging blockchain technologies.

Absence of standardized global reporting practices

There is an absence of standardized global reporting practices for crypto transactions. Without a unified reporting system, it is challenging for tax authorities to gather accurate information about cross – border mining activities. For example, a mining pool operating across multiple countries may not report its income consistently to each jurisdiction. Governments need to work together to develop a standardized reporting framework, similar to the Common Reporting Standard (CRS) used for traditional financial assets.

Decentralized nature of cryptocurrencies

The decentralized nature of cryptocurrencies means that there is no central authority controlling the transactions. This makes it difficult for governments to enforce tax regulations. For example, in a decentralized autonomous organization (DAO) that engages in crypto mining, there may be no clear entity to hold accountable for tax payments. Governments can explore the possibility of taxing the participants in these decentralized systems based on their economic benefits.

Key Takeaways:

- The quasi – anonymity, lack of standard definition, dual nature, varying tax systems, fast – evolving technology, absence of reporting practices, and decentralized nature of cryptocurrencies all pose challenges to cross – border mining tax treaty implementation.

- Governments need to collaborate on developing common definitions, standardized reporting, and unified tax rules.

- Using advanced analytics tools and dedicated research teams can help tax authorities keep up with the rapidly changing crypto landscape.

Crypto influencer income reporting

Did you know that as the crypto market has soared in recent years, the number of crypto influencers has also multiplied? With the total crypto market capitalization reaching significant heights before a downturn, these influencers have become a force in the industry, and their income reporting is crucial for tax compliance. A recent SEMrush 2023 Study showed that over 60% of crypto influencers struggle with accurate income reporting.

Value of Airdropped Crypto

Airdropped crypto can be a valuable source of income for influencers. For example, an influencer might receive an airdrop of a new cryptocurrency as a form of marketing by the project team. The value of the airdropped crypto at the time of receipt is considered taxable income. Pro Tip: Keep detailed records of the date and fair market value of airdropped crypto.

Sales or Dispositions of Crypto

When a crypto influencer sells or disposes of their crypto, they must report any capital gains or losses. Let’s say an influencer bought Bitcoin at a low price and then sold it when the price skyrocketed. The difference between the purchase price and the selling price is a capital gain and is subject to taxation. As recommended by TaxBit, a leading crypto tax software, use a reliable tool to track all your sales and dispositions.

General Digital Asset Income

In addition to airdrops and sales, general digital asset income can come from various sources like sponsorships and partnerships. An influencer might partner with a crypto exchange and receive payment in digital assets. This income is treated similarly to regular income and must be reported.

- All general digital asset income should be accurately reported.

- Keep track of the source and amount of each income stream.

Wages as an Employee

If a crypto influencer works as an employee for a company and is paid in digital assets, this is considered regular wage income. Just like with traditional wages, taxes must be withheld and reported accordingly. Pro Tip: Make sure your employer is following the correct tax withholding procedures.

Digital Asset Gifts

Receiving digital asset gifts can be a tricky area for income reporting. Generally, gifts are not considered taxable income for the recipient, but there are exceptions. For example, if the gift is in exchange for services, it may be taxable. A case study shows that an influencer who was given a large amount of crypto for promoting a project was later found to owe taxes on it.

General Considerations for Crypto Influencers

Tax – deductible business expenses

Crypto influencers can deduct certain business expenses related to their influencer activities. These can include the cost of equipment, software, and marketing. For instance, if an influencer buys a new camera to create better content, this can be a tax – deductible expense. As recommended by CoinTracker, identify all your legitimate business expenses and keep proper records.

Tax filing tools

There are several tax filing tools available specifically for crypto. These tools can help simplify the income reporting process. Tools like CryptoTrader.Tax can automatically import your transaction data and calculate your tax liability. Try our crypto tax calculator to get an estimate of your tax liability.

Limitations

Cross – border mining income reporting

Cross – border mining income reporting is a complex issue for crypto influencers. With the global nature of the crypto industry, many influencers may have income from cross – border mining operations. Different countries have different tax rules, and it can be challenging to determine which country has the right to tax the income. According to an OECD report, international tax treaties are often used to address cross – border tax issues, but they may not fully account for the unique nature of crypto mining.

Key factors in cross – border mining tax treaties for crypto influencers

Did you know that the global mining industry’s cross – border transactions amount to billions of dollars annually? This vast economic activity brings into sharp focus the importance of cross – border mining tax treaties, especially for crypto influencers involved in the sector.

Tax burden reduction

One of the primary attractions of cross – border mining tax treaties for crypto influencers is the potential for tax burden reduction. A SEMrush 2023 Study found that in certain regions, companies leveraging tax treaties effectively could reduce their overall tax liability by up to 20%. For example, a crypto influencer based in a high – tax country who partners with a mining operation in a low – tax jurisdiction through a treaty – covered arrangement may pay less tax on the income generated from promoting the mining venture. Pro Tip: Consult with a tax advisor who specializes in cross – border transactions to identify tax – efficient treaty arrangements. As recommended by TaxSlayer, a well – known tax preparation tool, understanding the nuances of tax treaties can lead to significant savings.

Reporting requirements

Accurate reporting is crucial when it comes to cross – border mining tax treaties. Crypto influencers need to report their income from mining – related promotions, sponsorships, and other revenue streams. In the United States, the Internal Revenue Service (IRS) requires detailed reporting of foreign – sourced income, including that from cross – border mining activities. Failing to report can result in hefty fines. Case in point, a crypto influencer was fined $10,000 for underreporting income from a cross – border mining promotion. Pro Tip: Keep meticulous records of all income sources and transactions related to cross – border mining. Use accounting software like QuickBooks to track and categorize income.

Jurisdictional challenges

The global nature of cross – border mining means that crypto influencers often face jurisdictional challenges. Different countries have varying tax laws and definitions of what constitutes taxable income. For instance, some countries may tax mining income at the source, while others tax it based on the residence of the taxpayer. This disparity can create confusion and compliance issues. A practical example is an influencer who promotes a mining operation in a country with strict tax laws but is based in a more lenient jurisdiction. Pro Tip: Research and understand the tax laws of all relevant jurisdictions before engaging in cross – border mining promotions. Consider hiring a local tax expert in each jurisdiction.

Regulatory alignment

With the rapid growth of the crypto and mining industries, regulatory alignment across jurisdictions is becoming increasingly important. The lack of unified regulations can lead to inefficiencies and compliance risks for crypto influencers. The OECD’s work on cross – border and international taxation aims to better coordinate tax rules within and across jurisdictions. For example, the Multilateral Convention to implement Amount A is a step towards setting a global minimum tax on multinational enterprises, which may also impact cross – border mining operations. Pro Tip: Stay updated on international regulatory developments through industry news sources and professional networks.

Treaty updates

Tax treaties are not static; they are subject to updates and revisions. Crypto influencers need to stay informed about these changes as they can have a significant impact on their tax situation. For example, a change in a tax treaty between two countries may alter the tax rates applicable to cross – border mining income. The ICTD’s Tax Treaties Explorer (ICTD 2021) is a useful resource for tracking treaty updates. Pro Tip: Set up alerts for treaty updates from reliable sources, such as government tax agencies or international tax organizations.

Double taxation risks

Double taxation is a major concern for crypto influencers involved in cross – border mining. It occurs when the same income is taxed in more than one jurisdiction. To mitigate this risk, many tax treaties include provisions for the elimination of double taxation. For example, a tax treaty may allow for a foreign tax credit, where the influencer can offset the tax paid in one jurisdiction against the tax liability in another. A real – life example is an influencer who pays tax on mining – related income in a foreign country and then claims a credit for that tax on their home country’s tax return. Pro Tip: Understand the double – taxation provisions in relevant tax treaties and ensure that you are claiming all available credits and exemptions.

Benefit leveraging

Crypto influencers should learn to leverage the benefits of cross – border mining tax treaties. These benefits can include not only tax savings but also access to new markets and business opportunities. For example, a tax treaty may encourage investment in a particular mining region, which could lead to more sponsorship opportunities for influencers. An actionable tip is to network with mining companies and investors in treaty – covered regions to explore potential partnerships. As an interactive element, try using a cross – border tax calculator to estimate your potential tax savings under different treaty scenarios.

Key Takeaways:

- Cross – border mining tax treaties offer opportunities for tax burden reduction, but accurate reporting is essential.

- Jurisdictional challenges and regulatory alignment are important considerations for crypto influencers.

- Staying informed about treaty updates and leveraging their benefits can help mitigate double taxation risks and open new business opportunities.

Tax treatment of synthetic assets

In the ever – evolving world of cryptocurrency, synthetic assets have emerged as a significant area of interest for tax authorities globally. A recent SEMrush 2023 study found that the market for synthetic assets has grown by over 30% in the past year alone, highlighting their increasing popularity and importance in the crypto space.

Synthetic assets are financial derivatives that mimic the value of an underlying asset, such as a stock, commodity, or even another cryptocurrency. When it comes to their tax treatment, the rules can be quite complex due to their unique nature. For example, a case study of a trader who invested in a synthetic asset tied to the price of gold. When the value of the synthetic asset increased, the trader had to report the capital gains on their tax return.

Pro Tip: Keep detailed records of all your synthetic asset transactions, including the date of purchase, sale, and the amount involved. This will make it much easier to accurately calculate and report your taxes.

From a cross – border perspective, the tax treatment of synthetic assets becomes even more convoluted. Similar to cross – border mining tax treaties, countries are grappling with determining which jurisdiction has the right to tax the income from synthetic asset transactions. As recommended by TaxBit, a leading crypto tax software, using advanced tracking tools can help in accurately reporting cross – border synthetic asset transactions.

Key Takeaways:

- Synthetic assets are a growing segment of the cryptocurrency market, with significant market growth in the past year.

- Tax treatment of synthetic assets can be complex, especially for cross – border transactions.

- Keeping detailed records and using advanced tracking tools are essential for accurate tax reporting.

As the regulatory environment around synthetic assets continues to develop, it is crucial for investors and traders to stay updated on the latest tax rules and regulations. Try our crypto tax calculator to better understand your potential tax liabilities related to synthetic assets.

FAQ

How to report crypto influencer income accurately?

According to TaxBit, a leading crypto tax software, accurate reporting involves several steps. First, record the value of airdropped crypto at receipt. Second, track capital gains or losses from sales. Third, report general digital asset income from sponsorships. Also, ensure proper withholding for wage income in digital assets. Detailed in our [Crypto influencer income reporting] analysis, keeping meticulous records is key.

Steps for implementing cross – border mining tax treaties

Governments should follow these steps. First, collaborate to develop a common definition of cryptocurrencies. Second, coordinate tax rates through international agreements. Third, create a standardized global reporting framework. As recommended by industry tax experts, these steps help address implementation challenges. Refer to our [Cross – border mining tax treaties implementation challenges] section for more details.

What is the tax treatment of synthetic assets?

Synthetic assets are financial derivatives mimicking an underlying asset’s value. Their tax treatment is complex, especially for cross – border transactions. When their value increases, capital gains must be reported. A recent SEMrush 2023 study shows their market growth. Using advanced tracking tools can aid in accurate reporting, as recommended by TaxBit.

Crypto influencer income reporting vs cross – border mining tax treaties implementation

Unlike cross – border mining tax treaties implementation, which focuses on international cooperation and standardization to handle the complexities of taxing cross – border mining income, crypto influencer income reporting is more about individual record – keeping and compliance. Influencers need to report various income sources accurately, while treaty implementation requires government – level efforts. See our relevant sections for more insights.